By: CameronPassmore

After obtaining your credit report from www.annualcreditreport.com, you should have a fair amount of information to go over. Many people are only interested in their credit score: do not make this mistake. A credit score is just a number, after all, and what you should really be interested in is what is driving that number. The only way to understand why your number is what it is (low or high) is to understand what is in your report.

Looking at Your Report

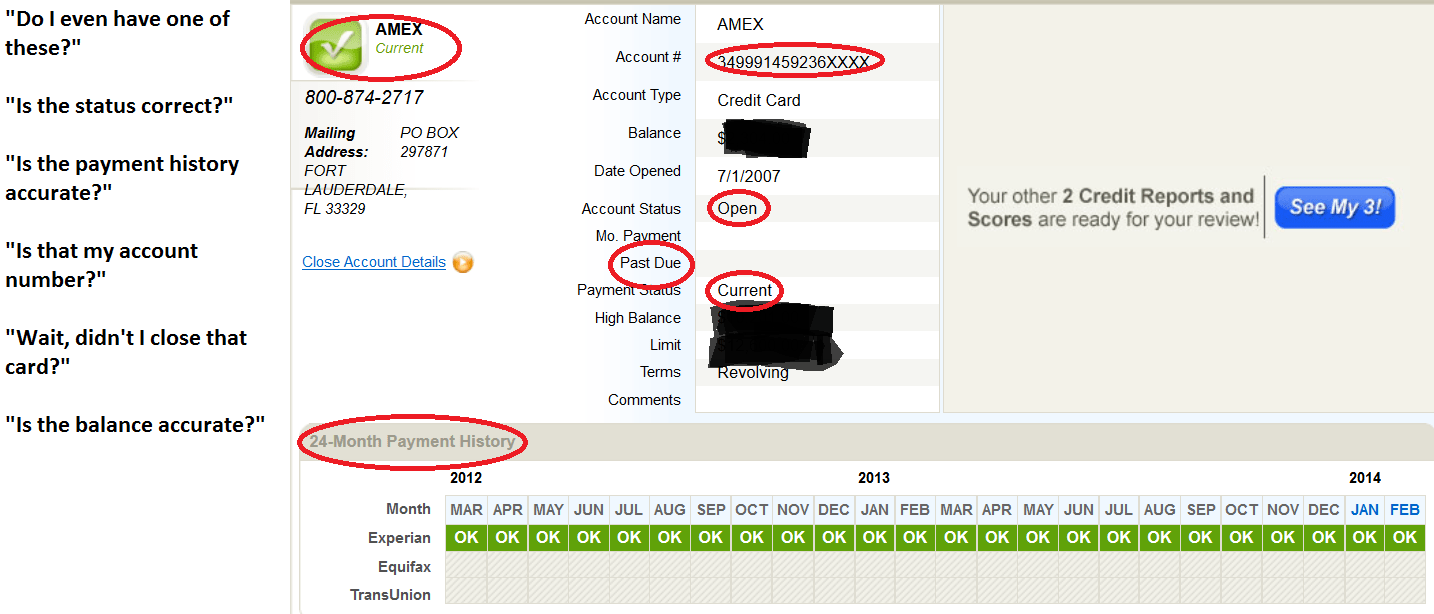

Your credit report is made up of a bunch of individual entries, such as the one shown above. The red circles highlight the portions of each item that you will want to review. At its simplest, this is an exercise in checking for accuracy. Nobody is in a better position than you to know if this data is correct. So ask yourself this question: does all of this look accurate? If something does not, then you may have found an actionable item that could improve your credit score.

Please remember that there is no such thing as harmless inaccurate data. For instance, a common error is a credit card that has been closed, but shows as still open on your credit report. It may have a spotless payment record and it may show a zero balance. But, it still tells creditors that you already have thousands of dollars of credit at your disposal that you do not actually have. Thus, there is a real difference between your actual capacity to manage another line of credit, and your capacity to do so as documented in your credit report. The difference between these two can increase interest rates on loans you apply for or in some cases even get you denied for a loan. More is not more, accurate is more.

Challenging Items

Now that you have identified an inaccuracy, it it time to act on it. The contact information for the three reporting agencies was provided in Part 1 of this series. The other contact information you will need to know is from the company that provided the information. As you can see, above, the entry on your credit report already contains this information!

The first thing you need to do is gather your evidence. Do you have receipts showing your payments? Confirmation emails? Printable online balances? A transaction history? Use it. You want everything that tells your side of the story. Remember that both the credit reporting agency and the information provider are required to keep your nonpublic data… nonpublic. They will need this information to make corrections to your report. Want to get really specific? Make copies of your credit report and circle the items in question.

Once you have compiled your evidence, write a letter explaining exactly what is wrong, exactly what it should be, and where in your evidence that can be verified. The final step is to sign the letter and make two copies of everything: one for the credit reporting agency, and the other for the information provider. The originals are for your own records.

In reality, this approach is somewhat redundant as both the agency and the information provider are obligated to work together to find a solution. But the extra copy is worth your time: both entities will have everything they need to act on your inquiry from day one, and even under the best of circumstances you are looking at about 30 days before you see any changes. A month might not seem that long, but imagine how long it could feel if it is standing in the way between your family and your next home: 30 days can be an eternity.

Investigation Complete

Once the reporting agency finishes with your inquiry, they are obligated to notify you of the results and to provide you a new copy of your report should your inquiry lead to a change in your credit report. They are also obligated to provide new information to anyone who requested your credit report in the last six months.

There is always the possibility that your credit report will not change. Remember that only inaccurate information will result in a change. Disputed charges may still appear: disagreeing with an item on your credit report is not enough to get it removed. You may, however, request that a statement be attached to your credit report regarding the disputed item. This statement will accompany your report, allowing you to provide context regarding the unchanged item.